Tariff revenue scale, recession outlook, defense VC spending

In today's issue, we explore tariff revenue surging, recession fears waning, defense VC climbing, Google dominance continuing, US-China GDP stabilizing, and America's medicine spending leading.

1. US tariff revenue is rising, but $40bn is not a huge number

Source: FT

Yale Budget Lab estimates 2025 tariffs will raise $2.4T over 2026-35, while Tax Foundation projects a 10% universal tariff would generate $2.2T (0.6% GDP), 15% tariff $2.9T (0.8% GDP), and 20% tariff $3.4T (0.9% GDP) over 2025-2034. Important caveats: net tariff revenue typically only 80-85% of gross figures due to refunds; income/payroll tax offsets reduce effective revenue by ~25-26.6%. Short-term revenue surge may impact 2025 debt limit dynamics and factor into Congressional plans for extending expiring tax cuts. Despite headline-grabbing increases, $40B represents relatively small contribution to overall federal revenue picture.

2. Recession chances are falling

Source: The Daily Shot

Recession risk declining sharply: Goldman Sachs also cut US recession probability from 45% to 35% following tariff truce. NY Fed Treasury Spread model shows 30.45% probability for April 2026, based on -0.034386% spread between 10yr bonds and 3-month bills. Current economic indicators show no imminent recession signals, but market volatility persists with US cargo shipments dropping 60% since April, threatening retail inventory and prices by mid-May. Gold prices fell 1% to $3,289.97 as the dollar strengthened despite being down 6% YTD, reflecting shifting investor sentiment away from safe-haven assets.

3. US VC defence spending is rising

Source: The Daily Shot

Historical investor hesitancy reversing due to global instability and growing sector knowledge. Global defence spending reached $2.46T in 2024, up from $2.24T in 2023 with real-terms growth of 7.4%. Global VC investments in defence-related companies jumped 33% YoY to $31B in 2024, with AI leading ($12B), followed by next-gen communication networks and autonomous systems ($4B each). Industry expects increased defence spending under new White House administration, likely driving further sector interest.

4. Google and YouTube still by far the most visited sites on the internet

Source: The Daily Shot

Despite LLM-mania, Google remains the world's digital gateway: it dominates global search (90%+ share), sets content discovery norms, and powers their powerful ecosystem (Gmail, Maps, Drive). YouTube is a video monopoly; unrivalled for user uploads, music, streaming, education, and the creator economy. Both benefit from high device preinstallation, seamless integration, and lethal algorithmic recommendation, locking in habitual daily usage. Network effects (users/content fueling more users/content) reinforce their lead. No rival matches Google’s search breadth or YouTube’s engagement depth. Rising competitors (TikTok, Reddit, ChatGPT) are still single-digit billions in monthly visits—gap remains massive.

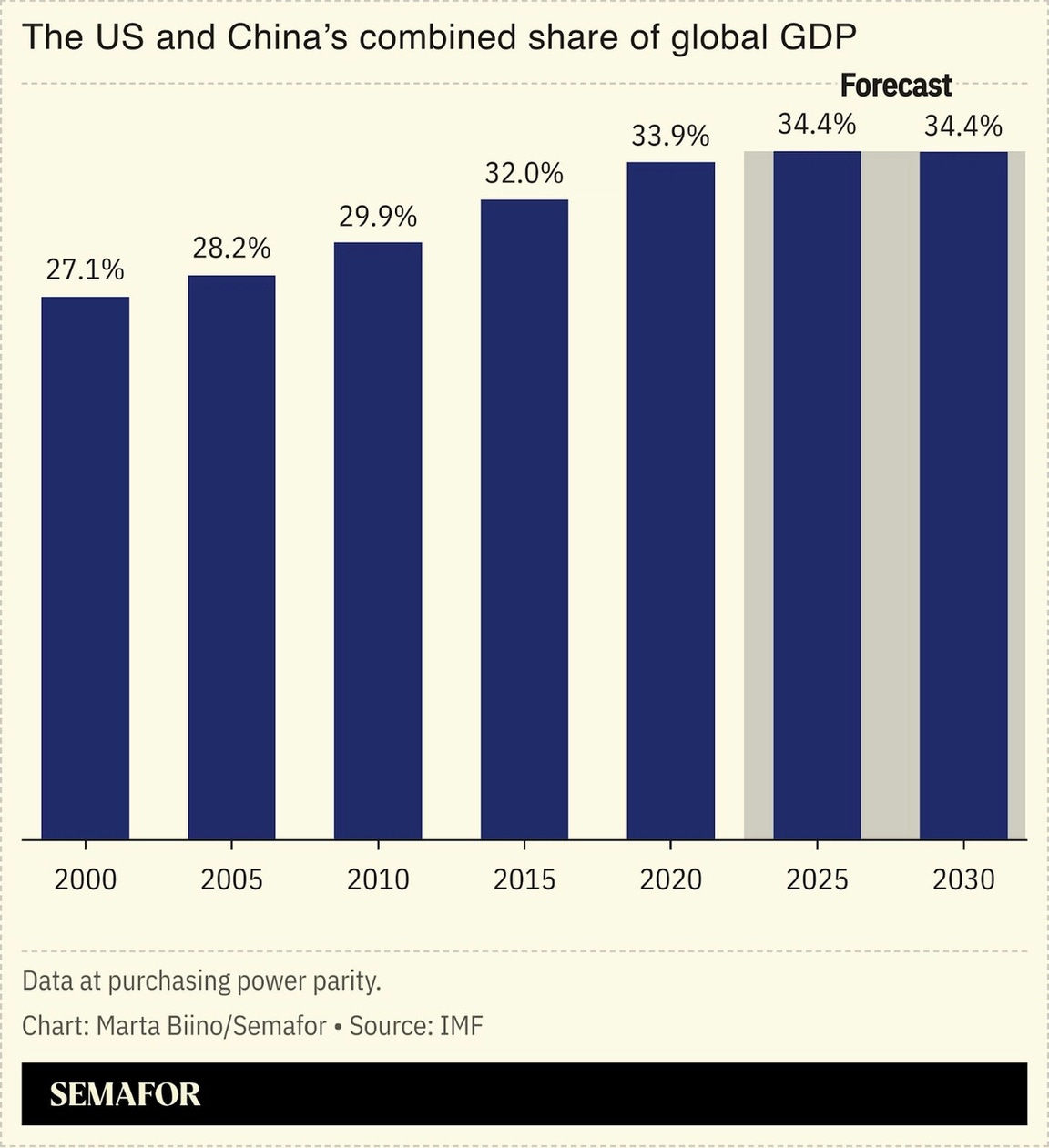

5. The US and China's combined share of global GDP is stabilizing

Source: Semafor

US-China GDP dominance continuing but stabilizing at ~43% of global $115T economy in 2025, with US maintaining its 100+ year lead at $30.3T vs China's $19.5T. Key context: Germany ($4.9T) reclaimed 3rd position from Japan ($4.4T) in 2024; India, now 5th, projected to surpass Japan by 2026 and Germany by 2028, signalling emerging economic power realignment. China's dramatic growth trajectory since 1978 market reforms continues but at moderated 5.2% real GDP growth (2023), suggesting maturation phase rather than continued exponential expansion. IMF projections indicate this US-China duopoly will maintain relative stability through mid-decade despite *everything* happening.

6. US per capita spending on medicines is so much higher than other countries

Source: Semafor

Key factors driving this disparity (which is so shocking to Europeans like me): historical pricing structures, high insurance coverage (92.5% insured share in 2023, highest on record), and increasing healthcare utilization post-pandemic. US prescription drug expenditure alone hit $805.9B in 2024 (+10.2% YoY), driven largely by weight-loss medications adoption. 2025 projections indicate 9-11% further growth in Rx spending despite anticipated slowdown in overall healthcare spending to 4.2%. Trump's May 2025 executive order aims to reduce federal drug program costs by 59-90% through international reference pricing, though facing likely legal challenges.