Musk-Trump stocks, China emissions reversal, ChatGPT traffic milestone

In today's issue, we delve into market impacts as Musk-Trump tensions rattle sensitive stocks, China's milestone CO2 decline driven by clean energy expansion, ChatGPT's traffic surpassing Wikipedia's.

1. Musk tiff damages Trump-sensitive shares

Source: Sherwood

Tesla shares plummeted 14% on June 5, 2025, erasing ~$150B in market value after the Musk-Trump relationship publicly collapsed, high school style. Worst 2-day stretch for Tesla since Nov 2021 (-16.25%) due to the Trump-Musk fallout crushing Tesla stock. If you don't already know: feud ignited when Musk labeled Trump's signature "One Big Beautiful Bill" a "disgusting abomination" and warned Trump's "tariffs" would trigger US "recession" by H2 2025. Trump expressed "disappointment" in Musk during a White House press conference with German Chancellor Merz, suggesting Musk opposed the bill after learning EV subsidies would be cut. Musk retaliated by resurfacing Trump's deficit concerns on X. Markets also reacting to potential regulatory repercussions for Tesla and broader economic uncertainty from proposed tariffs. Former allies now engaged in escalating public feud with immediate market consequences.

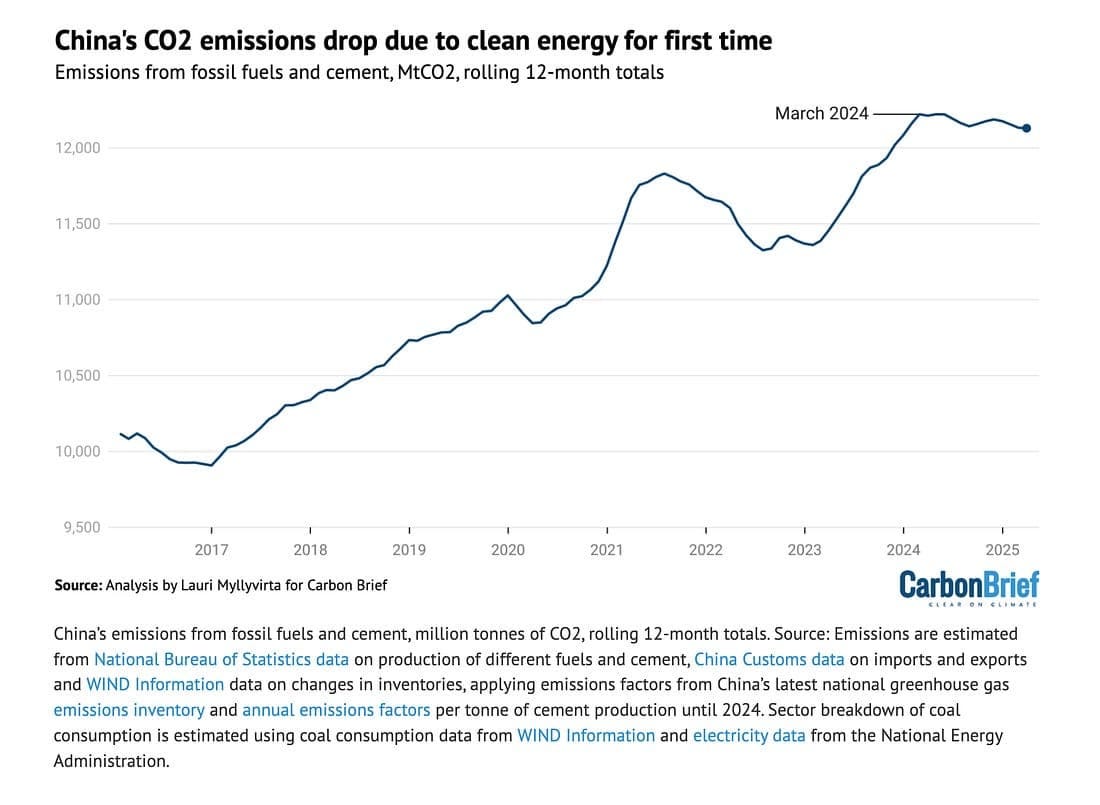

2. China's CO2 emissions drop due to clean energy for the first time

Source: CarbonBrief

China's CO2 emissions reversed course, declining 1.6% YoY in Q1 2025 and 1% over trailing 12 months – first decline not driven by economic weakness. Clean power generation growth (wind, solar, nuclear) now outpacing electricity demand growth, pushing down coal usage despite robust 2.5% power demand surge. Power sector emissions fell 2% YoY in 12 months to March 2025, as clean energy initiatives took effect. Structural shift occurring as renewables consistently cheaper than coal. However, emissions remain just 1% below recent peak, risking new records with any short-term jumps in China's carbon emissions amid a clean energy surge. Trend confirms projections that China would peak emissions before 2025, beating the 2030 Paris Agreement target by 5+ years. Conservative scenarios predict 0.5% annual emissions decline through the decade; optimistic scenarios show a steeper 1% annual decline (potentially saving 750 MtCO2 by 2030).

3. ChatGPT traffic has overtaken Wikipedia

Source: Chartr

ChatGPT monthly visitors surpassed Wikipedia in May 2025—ChatGPT climbed above 5.4B visits, overtaking Wikipedia for the first time. ChatGPT saw a 36% YoY user surge, and a 13% MoM traffic spike in April 2025, boosted by features like image generation. Meanwhile, Wikipedia’s monthly unique visitors dropped 16.5% (March 2022–March 2025), losing ~200M unique users and 14–18% of total traffic. Key drivers: Search engines now provide “zero-click” AI summaries, reducing Wikipedia referrals. AI’s rapid adoption (education, work, everyday queries) is shifting general-purpose web discovery from static, curated articles to dynamic, generative responses, reflecting a broader redefinition of how internet users access and perceive authority in information.

4. The US invests by far the most in AI companies

Source: Semafor

US AI private investment soared to $109.1 billion in 2024—nearly 12x China's $9.3 billion and 24x the UK's $4.5 billion according to the Artificial Intelligence Index Report 2025. Gap widening YoY, particularly in generative AI where the US exceeded China + EU + UK combined by $25.4B (up from $21.8B gap in 2023). Total US AI market valued at $73.98B with projected 26.95% CAGR through 2031. Five AI hyperscalers alone projected to spend >$1T collectively in capex from 2024-2027, cementing US leadership position amid global competition for AI supremacy.

5. High earners tend to think they're better at flirting

Source: Civic Science

"High-earner flirting confidence" phenomenon reflects correlation between income and relationship self-perception. Research shows men with higher incomes experience a marriage premium (income boost post-marriage), potentially reinforcing belief in superior romantic skills. Gender dynamics compound issue: masculine-identifying individuals tend toward overt flirtation tactics while feminine-identifying prefer subtle nonverbal cues, regardless of sexual orientation. Four-factor analysis of flirtation behaviors (nervousness, togetherness, lovemaking, prosocial) suggests high-earners may excel in prosocial flirtation category while misinterpreting responses.