More Musk misfortune, daughters, China's EV debt

In today's issue, we explore Musk-Trump feud fallout, infanticide decline, credit debt silence, China's EV dominance, and dining-out trends.

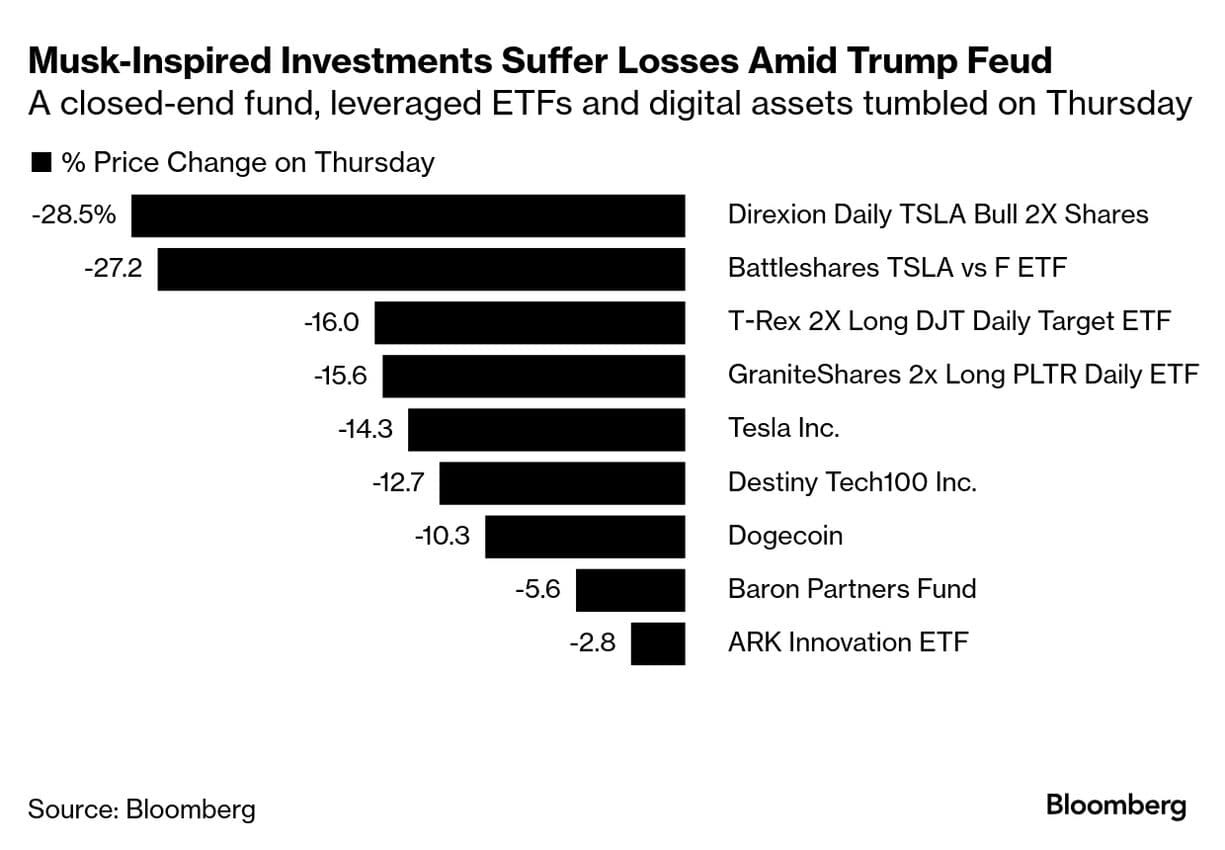

1. The hammering of Musk-related investments after the Trump feud continues

Source: Bloomberg

Musk-related equities—including Tesla, SpaceX, and Muskovite ETF proxy—fell 7–14% in past 72hrs post-Trump feud escalation (June 5) as Musk attacked Trump’s "Big Ugly Spending Bill," triggering Trump’s threats to strip SpaceX NASA contracts and cut EV tax credits. Market repricing reflects heightened policy/political risk: potential loss of federal subsidies, contract cancellations, and weakened GOP alignment. Musk’s veiled threat to pause NASA crew transport projects and his apparent break with the GOP base (“Trump has 3.5 yrs, I’ll be here 40+”) amplified investor fears of a protracted, high-profile rift. Outflows intensified after Musk’s impeachment endorsement post; risk-off sentiment highest in sectors with direct government exposure. Downward momentum persists as both parties remain entrenched, with no reconciliation signals; volatility, short interest spike, and options volumes at year highs related to the ongoing feud and friendship between Trump and Musk.

2. Female infanticide has plummeted

Source: The Economist

This is good news. India reached a demographic milestone in 2021: 1020 women per 1000 men, though the sex ratio at birth (SRB) is still abnormally skewed. Pew Research Center identified ~9M "missing girls" in India (2000-2019), with 7.8M from Hindu backgrounds vs lower rates in Muslim populations. China's situation improving post-One Child Policy abolishment (replaced with two-child policy in 2015, three-child policy in 2021), though legacy effects continue with estimated 31-32M "missing girls" under age 20 across China and India combined. Progress is threatened by funding cuts to maternal/child health programs, particularly affecting humanitarian crisis zones and debt-burdened nations. Girls remain disproportionately vulnerable to gender-based infanticide, child marriage, education denial, and mobility restrictions worldwide. The fight goes on.

3. People with credit card debt often suffer in silence

Source: LendingTree

We've covered debt recently, and this is an interesting (and sad addition to the narrative). 87% of Americans would be embarrassed to admit credit card debt; two-thirds perceive heavier stigma for credit card debt vs. other debt types. Rising balances: average cardholder with unpaid debt owed $7,321 in Q1 2025, up 5.8% YoY; national total exceeds $1.3T according to 2025 Credit Card Debt Statistics. Emotional overspending is common (50%); regret is prevalent, but over 70% would still incur card debt for essentials. Silence likely driven by shame, cultural taboos around financial “failure,” and gender/age disparities—more women report unmanageable debt (39% vs. 31% of men, with younger adults and minorities at higher risk for stigma and financial distress. Social isolation, fear of judgment, and internalized blame perpetuate the cycle of secrecy.

4. China's lead in EV production is stunning

Source: Semafor

China accounts for over 70% of global EV output in 2024, sustained by aggressive state policy including subsidies, charging infrastructure buildout, and emissions targets, plus private and foreign investment. NEVs (BEV+PHEV) are ~50% of China’s 2025 passenger vehicle market, dwarfing US/EU share. China has a well publicised ecosystem advantage, including domestic tech/scale (battery, supply chain), strong price competition and government mandates for taxi/fleet electrification in mega-cities. Foreign automakers see China as an essential EV market—ongoing local investment fuels innovation, capacity.

5. People were still spending most of their food money dining out last year.

Source: Chartr

FAFH (food away from home) spending eclipsed FAH (food at home) in 2023: $1.5T vs. $1.1T. FAFH rise outpaces FAH—up 13.5% since 2019 vs. FAH’s 3.4% (inflation-adjusted) Consumer Dining Trends. Between 2022-2023, FAH fell 2.6%, while FAFH rose 5.1%. Average American spends $166/mo on dining out; men spend 19% more. 42% of diners typically spend $11–$20 per person per meal; only 8% spend $50 or more according to 2024 Consumer Dining Trends and Statista. Wealth gap drives trend: high earners (>$100k) “over-index” for frequent dining out and larger spend, while lower-income groups focus on value or reduce frequency. Takeout remains a top “luxury” spend for all brackets. 2024 saw restaurant spending fluctuate but finish strong; end-of-year sales growth reached 1.1% YoY at restaurants. Long-term drivers: time poverty, urban living, dual-income households, and post-pandemic normalization of convenience culture. Despite economic worries and income disparities, eating out sustains appeal due to habit, perceived value, and social factors.