CEO pay growth, teen social media harm, unpredictable papal elections

In today's issue, we examine CEO pay hikes, teen tech concerns, papal election uncertainties, Meta's market dominance, horror film success, and US AI leadership.

1. CEOs of S&P 500 Firms continue to be paid more and more.

Source: The Daily Shot

The numbers seem excessive, but these trends are driven by shareholders. Pay rises closely track total shareholder return: 2023 TSR was +26%, 2024 +15.1%—in years of high returns, CEO pay historically rises; when returns are low, pay is flat. This is because CEO pay is largely performance-driven, not base salary-led; most compensation now comes from variable, market-linked components, reflecting shareholder preference for "pay for performance" alignment.

2. More and more teens think social media is harmful.

Source: Pew Research Center

Gender disparities (not visible in this chart) are significant here. WHO data indicates 11% showing problematic social media behavior, with girls exhibiting higher rates (13% vs 9%). Emotional impacts include 45% of girls feeling overwhelmed by social media drama (vs 32% boys), 37% experiencing FOMO (vs 24% boys), and 28% reporting negative life comparisons (vs 18% boys). Social media penetration remains extensive with up to 95% of teens 13-17 using platforms, nearly two-thirds daily.

3. Papal elections are impossible to predict

Source: Polymarket

Yet again, the bookies were all wrong on the new pope - betting markets gave Prevost virtually 0% of victory a few days ago. Conclave secrecy, unpredictable coalition shifts, and regional bloc dealmaking rendered betting markets ineffective. Prevost’s eventual election on the fourth ballot (new papal name: Leo XIV) underscored a surprise consensus candidate scenario, driven by behind-the-scenes negotiation and the absence of a unifying frontrunner.

4. Meta has outperformed Big Tech peers this year

Source: Bloomberg

The reason: ads, ads, ads. Meta's core ad business buoyed by improved AI targeting, ecosystem growth, and positive monetization trends, offsetting peer slowdowns amid valuation/market correction pressures. Peers have been dragged by growth fears, regulatory scrutiny, and weaker guidance; Meta’s adaptability and ad recovery set it apart.

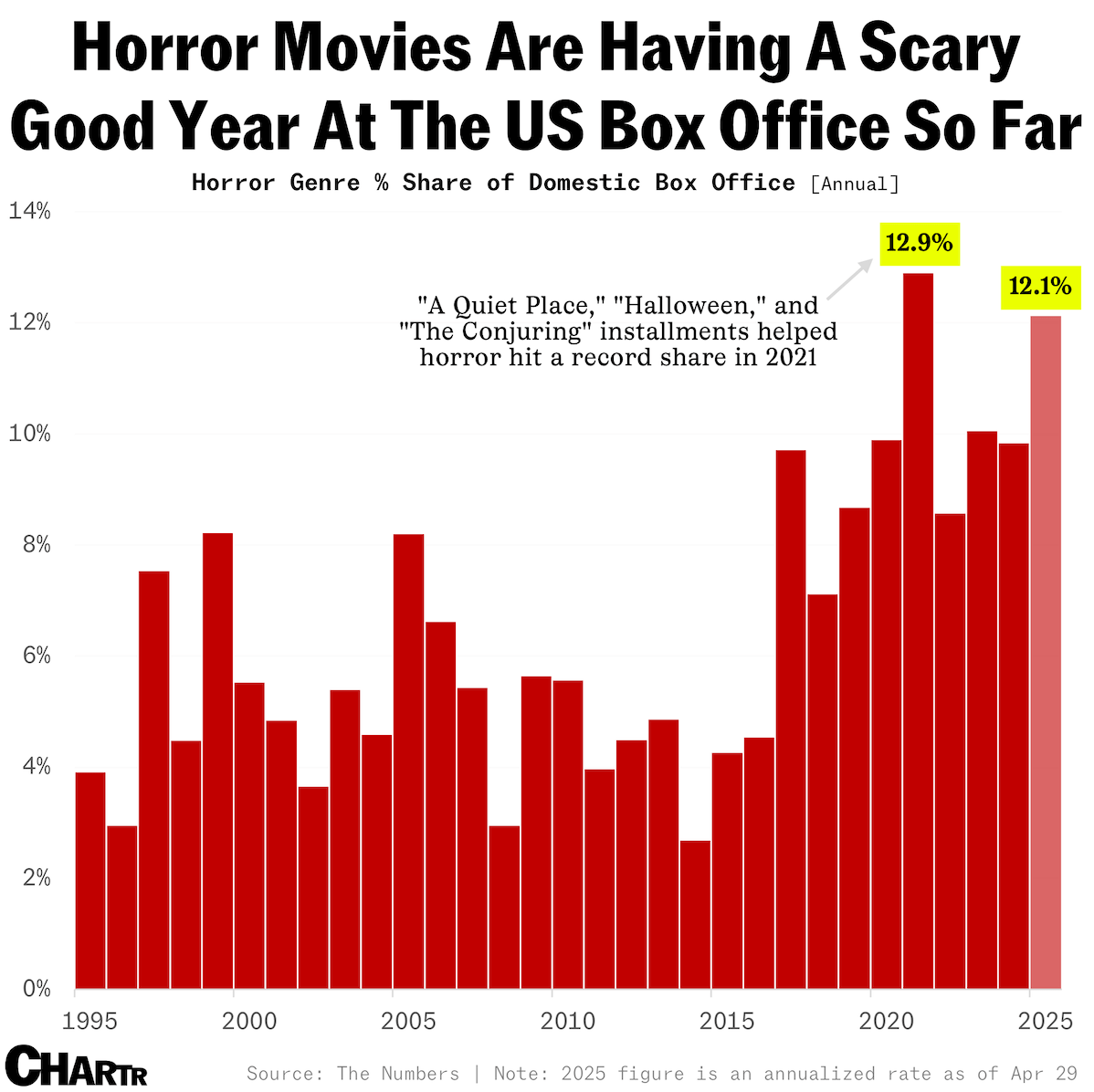

5. Horror movies are having a great year at the US box office

Source: Chartr

Horror movies are 2025’s fourth highest-grossing US genre YTD (+2% YOY; $54M+ by late Feb) amid broader market strength, with "Sinners" especially dominant—$215.3M domestic, fastest R-rated horror to $200M milestone, $48M record Easter debut, outpacing all but three prior R-rated horror titles historically. This surge has been driven by breakout hits, robust slate, and continued low-to-mid budget production attracting risk-averse studios seeking high ROI. Horror’s creative elasticity—blending action, comedy, romance—seems to have enduring cross-generational appeal.

6. US outpaces China in AI benchmark performance

Source: Semafor

US sustained benchmark lead driven by overwhelming private investment ($109.1B vs China’s $9.3B in 2024), leading to the production of 40 major models (vs China’s 15). Also critical: leveraging an elite academic pipeline, immigration-fueled talent inflow, and cutting-edge access to advanced semiconductors. Post DeepSeek, China’s models have still narrowed the quality gap from double-digit lag in 2023 to near parity by early 2025—now trailing US leaders by just 3–6 months.